The #1 Rated Retirement App

SAME BITCOIN.

LESS TAXES.

Invest in bitcoin & thousands of other assets without paying a dime in capital gains taxes.

open an account in 15 minutes or less

You’ll Pay Less Taxes On Your BITCOIN With Choice

When you open a Choice Account, you are opening an Individual Retirement Account — an IRA for short.

You do not owe any taxes until after you withdraw the money from your Choice Account & if you’re eligible for a Roth IRA, you won’t owe any taxes — ever. Learn more about IRAs 👉

You’ll Pay Less Taxes On Your BITCOIN with Choice

You do not owe any taxes until after you withdraw the money from your Choice Account & if you’re eligible for a Roth IRA, you won’t owe any taxes — ever. Learn more about IRAs 👉

Built By Bitcoiners, For Bitcoiners

Built By Bitcoiners, For Bitcoiners

Play Blinko to Win FREE BITCOIN Daily

Nearly 50% of Americans under the age of 30 have $0 saved for retirement – we want to change that.

Choice is the only retirement account that gives you free bitcoin every single day to help you save for your future. Log-in, drop a chip, and start stacking free sats.

Play Blinko to Win FREE BITCOIN Daily

Nearly 50% of Americans under the age of 30 have $0 saved for retirement – we want to change that.

Choice is the only retirement account that gives you free bitcoin every single day to help you save for your future. Log-in, drop a chip, and start stacking free sats.

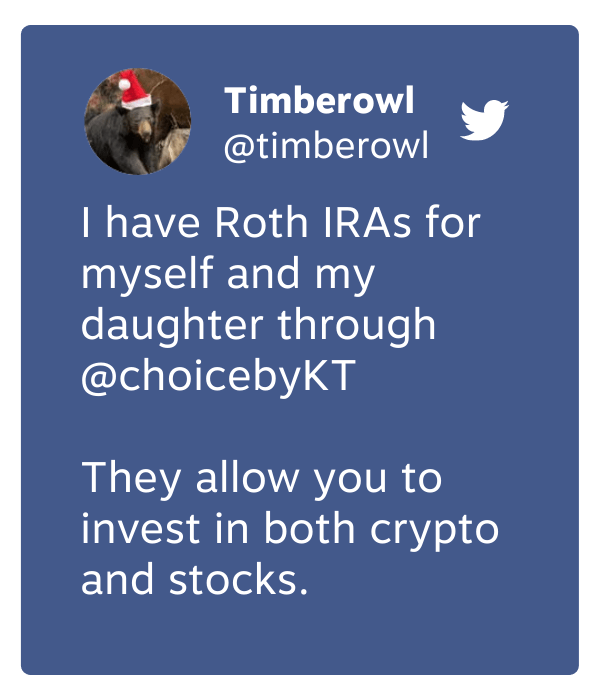

It’s Your Money, It Should Be YOUR CHOICE

Legacy banks force you to invest in cookie-cutter funds & other self-directed IRAs require you to have a separate account to invest in bitcoin.

Choice enables you to choose how you save for your future. You can invest in bitcoin, crypto, stocks, ETFs, gold & more all in a single retirement account. What assets are available on Choice? 👉

It’s Your Money, It Should Be YOUR CHOICE

Legacy banks force you to invest in cookie-cutter funds & other self-directed IRAs require you to have a separate account to invest in bitcoin.

Choice enables you to choose how you save for your future. You can invest in bitcoin, crypto, stocks, ETFs, gold & more all in a single retirement account. What assets are available on Choice? 👉

Is Choice App Right For Me?

Bitcoiner

Hold your own keys, win free bitcoin daily, and start your tax-efficient stack.

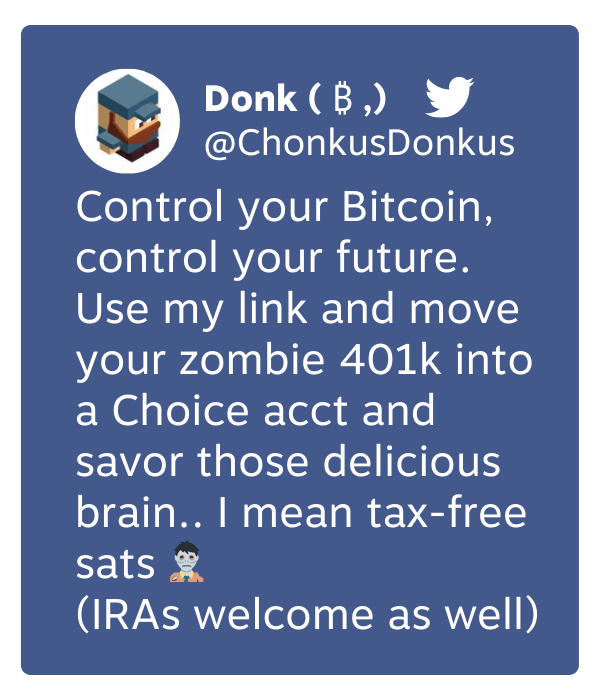

401(k) Holder

Combine all your zombie IRAs & 401(k)s into one, easy-to-manage account.

Trader

Stop paying up to 37% in capital gains taxes on your bitcoin, crypto, and stock trades.

New Investor

There’s no better place to start investing than in a tax-efficient account.

Is Choice App Right For Me?

Bitcoiner

Hold your own keys, win free bitcoin daily, and start your tax-efficient stack.

401(k) Holder

Combine all your zombie IRAs & 401(k)s into one, easy-to-manage account.

Trader

Stop paying up to 37% in capital gains taxes on your bitcoin, crypto, and stock trades.

New Investor

There’s no better place to start investing than in a tax-efficient account.

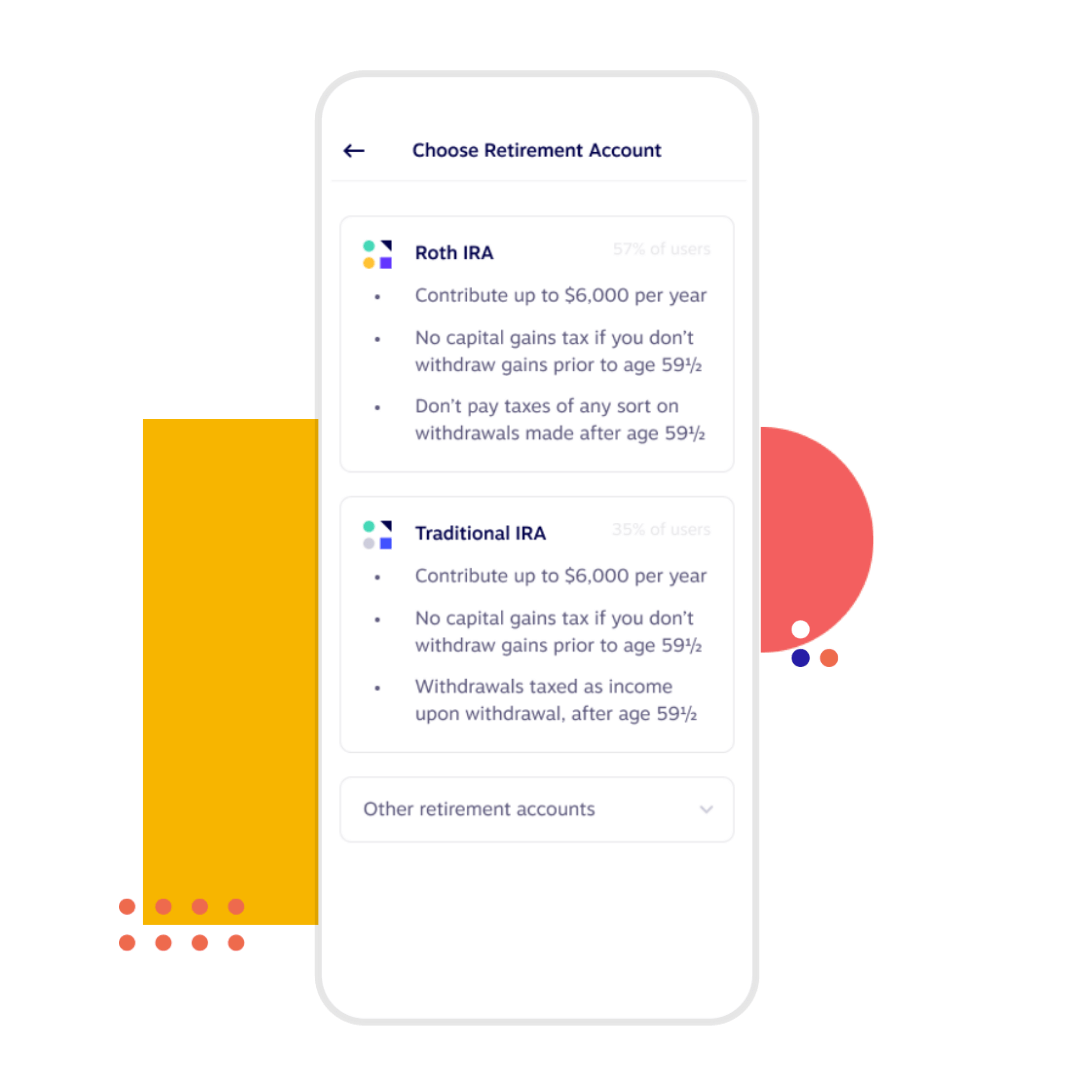

We Have 2 Account Options

Both less expensive than sharing your gains with Uncle Sam

Cold Storage

$0 Setup Fee

1% Annual Fee for Digital Asset Custody*

Hold Your Own Keys

$625 Setup Fee

$13.33 Per Month

For both account options, there is no minimum balance required to get started & trade fees on digital asset trading. Still not sure which to pick? Trust your gut, you can always change later!

*Minimum $20/month custody fee

Ready To Get Started?

It only takes 5 minutes to open your Choice Account

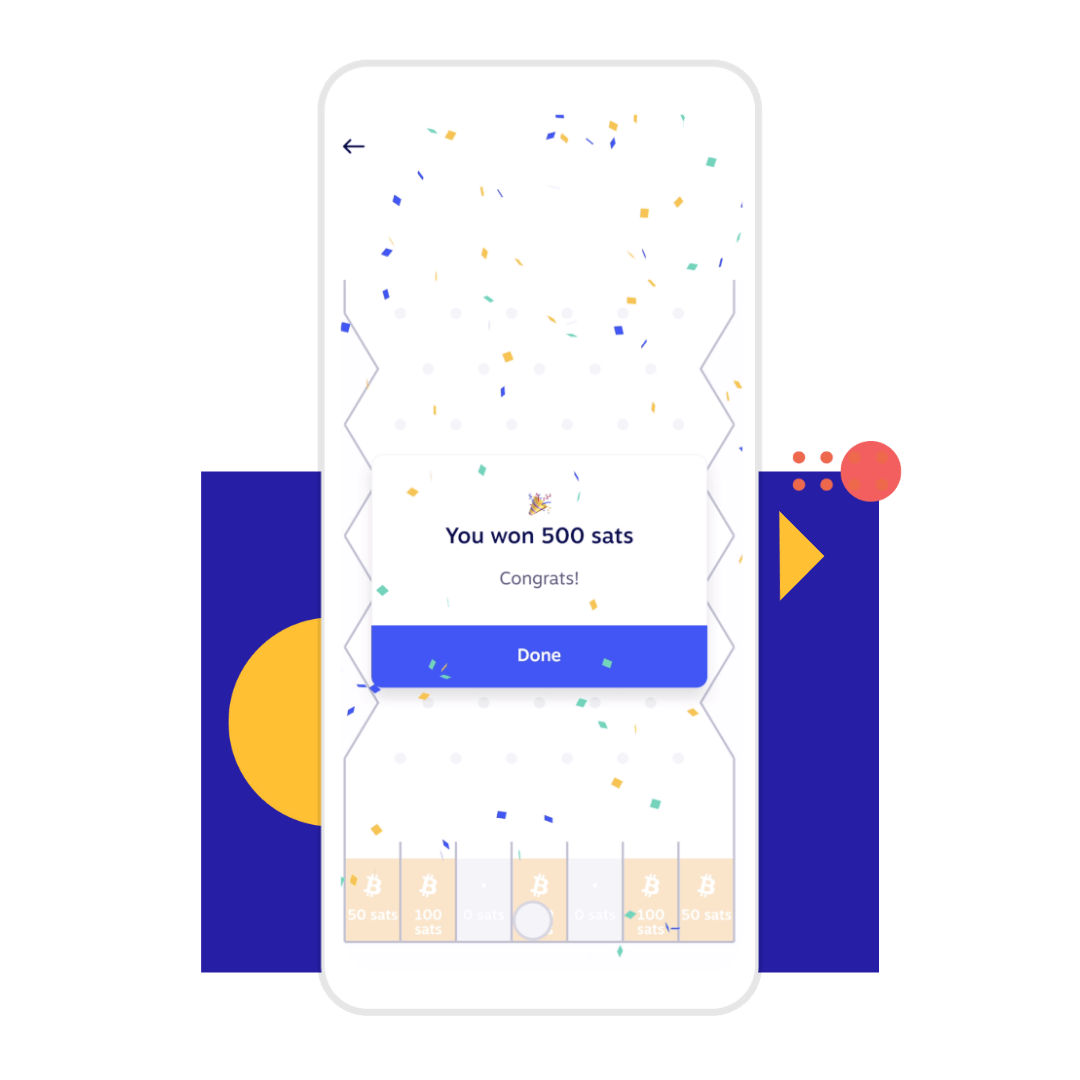

STEP #1

Play Blinko

Install Choice App on iOS or sign-up via your browser & immediately start earning free bitcoin by playing Blinko.

STEP #2

Create Your Account

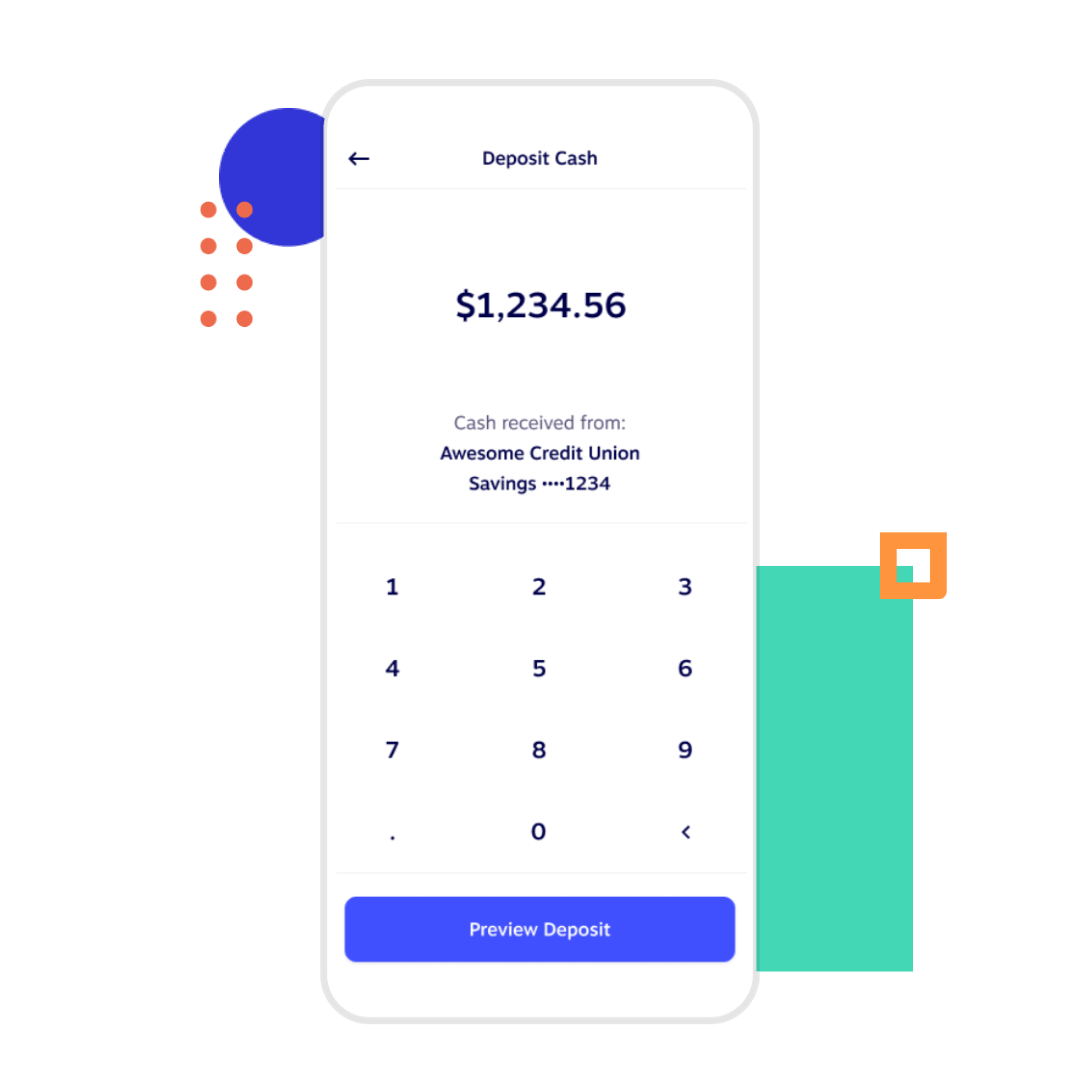

Choose which type of IRA is right for you & how you’d like to store your assets. Make sure you have your SSN and a valid ID handy!

STEP #3

Fund Your IRA

There are 3 different ways to fund your Choice Account. You can make a contribution, transfer funds from an existing IRA, or rollover assets from an old 401(k) – learn how 👉

Why Choice?

Top Rated Retirement App

More than 1,000 5-star reviews

All Your Assets in One Account

Bitcoin, crypto, stocks, and more in a single account

Win Free Bitcoin in Your IRA Everyday

Choice is the only IRA that pays you to save

Pay Less Taxes on Your Investments

Save up to 37% in capital gains taxes

Hold Your Own Keys in your IRA

Choose your own setup to keep your bitcoin safe

Industry Leading Security

Powered by institutional providers

We’ll Help You Find Your Old 401(k)

Our team works with you to make rollovers easy

Connect Your Bank With Plaid

Funding made easy with Plaid

Transfer, Rollover, & Contribute

Combine all your old retirement accounts